Why US airlines avoid Dubai

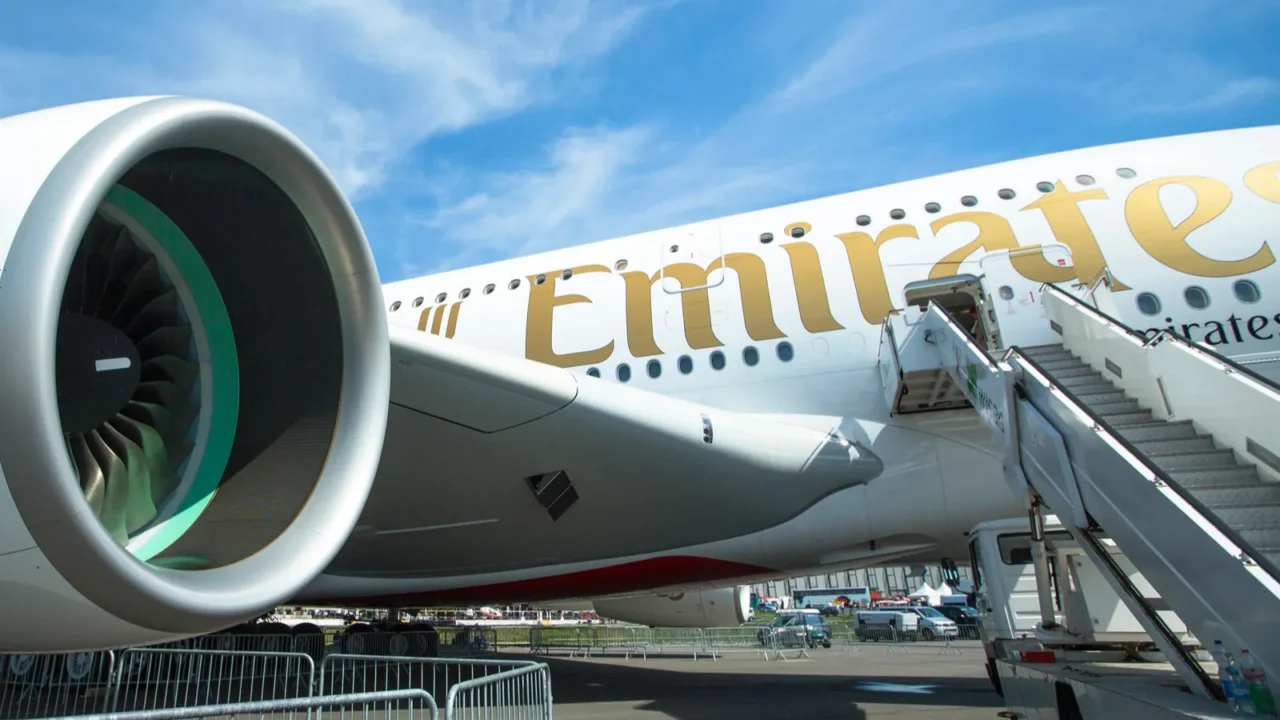

Ever noticed you can book an Emirates flight from New York to Dubai, but not on Delta or American? It’s not because Americans don’t want to go; millions do. The real reason has more to do with money, politics, and safety than demand.

For years, U.S. airlines and Gulf carriers have battled over subsidies, market power, and now even security risks. It’s a clash that explains why only one major U.S. airline still flies to Dubai.

Delta’s retreat in 2016

Delta tried flying from Atlanta to Dubai but pulled out in 2016. The airline said the market was flooded with Emirates flights, making profits impossible. It was one of Delta’s boldest route cuts at the time.

Even though Delta had good passenger numbers, the extra capacity meant ticket prices dropped too low. Competing with subsidized rivals was a fight they couldn’t win. The airline shifted its focus back to Europe and beyond.

American never entered Dubai

Unlike Delta, American Airlines never launched flights to Dubai at all. Instead, it chose to fly to Doha, Qatar, using its partnership with Qatar Airways. That strategy kept it out of a direct showdown with Emirates.

This gave American a way to reach the Middle East without directly battling Emirates or Etihad in their own home hub. Passengers could still reach Dubai by connecting through Doha. It was a safer path into the region’s markets.

United keeps a foothold

United Airlines took a different path. It restarted flights to Dubai after a U.S.–UAE agreement in 2018 that pushed for more transparency. This move made United stand out among U.S. airlines.

United still flies passengers from Newark to Dubai, keeping a U.S. presence in the market while others stepped back. The route attracts both business and leisure travelers. Demand has proven steady despite global challenges.

The Open Skies fight

At the center of the feud was the Open Skies agreement, which is supposed to create a level playing field between countries. It was designed to boost competition and expand flight options.

U.S. airlines argued that billions in Gulf subsidies broke the spirit of the deal, while Gulf carriers insisted they were simply growing fast and running efficiently.

A truce in 2018

After years of heated arguments, the U.S. and UAE reached a compromise in 2018. Emirates and Etihad agreed to share more financial details. This quieted tensions that had dominated headlines.

The deal calmed tensions, but by then, Delta and American had already stepped away from direct UAE flights. Their networks had shifted to other regions. Returning to Dubai never became a priority again.

Security tensions in 2025

Business disagreements weren’t the only problem. In mid-2025, fighting between Israel and Iran raised safety concerns across the region. Airlines couldn’t ignore the warnings from governments.

Delta, American, and even United temporarily suspended Middle East flights, including Dubai and Doha, after U.S. warnings about risky airspace. Safety was placed above profit in these decisions. Travelers were forced to adjust quickly.

Why airlines pause routes

When violence escalates in a region, airlines often cancel or reroute flights. Safety comes first, and governments issue strong advisories. These alerts can instantly change airline schedules.

These pauses don’t always last forever, but they show how quickly airlines must react to keep passengers out of danger. It’s a reminder of how fragile global travel can be.

How subsidies matter

Airlines everywhere rely on some government help, but critics said Gulf carriers had an unusually strong advantage. Their backing gave them room to expand aggressively. Few rivals could match that pace.

With lower costs, they could run more flights and undercut ticket prices, leaving U.S. carriers struggling to break even. It shifted market power toward the Gulf hubs. U.S. carriers saw this as a long-term threat.

What passengers noticed

For travelers, the dispute mostly meant fewer choices on U.S. airlines for direct Middle East trips. Flyers noticed gaps where U.S. carriers had pulled back. Many switched to Gulf airlines without hesitation.

Most ended up flying Emirates, Etihad, or Qatar Airways anyway, as those airlines offered more routes and better connections. Comfort and price often won out over loyalty. Gulf carriers built strong reputations among U.S. travelers.

Qatar’s role in the story

Qatar Airways also faced subsidy accusations but responded with open books and global expansion. Its strategy was to keep building trust and visibility. That helped soften some criticism.

American partnered with Qatar, letting customers connect through Doha instead of Dubai, a choice that still shapes routes today. Doha grew as a major transfer hub for U.S. passengers. The link remains important in 2025.

The 9/11 controversy

The debate escalated in 2015 when Delta referenced the fact that several 9/11 attackers came from Gulf nations, a comment critics said was inflammatory and irrelevant to the airline dispute. The remarks caused international backlash. Relations sank to new lows.

The comments caused outrage in the Middle East and worsened already tense relations between U.S. and Gulf carriers. Critics said the claims were unfair and damaging. The issue made the feud even harder to resolve.

Open Skies benefits

Despite the disputes, Open Skies agreements made air travel cheaper and more accessible for millions. Travelers gained routes that didn’t exist before. Prices dropped in many markets.

Travelers gained more options, more flights, and sometimes lower fares, even as airlines fought over fairness behind the scenes. The agreements unlocked global connections. For passengers, that was the biggest win.

United’s current position

Today, United is the only major U.S. airline flying direct to Dubai. The airline sees strong demand on the route. Customers continue filling seats.

Still, the airline also pauses flights when tensions rise, showing that even profitable routes aren’t immune to global risks. It balances opportunity with caution. That approach has kept United in the market.

Delta’s strategy now

Delta focuses instead on European and Asian connections, avoiding the direct Middle East market for now. Its hubs in Europe link passengers onward. This helps cover demand indirectly.

By teaming with partners like Air France and KLM, Delta passengers can still reach Dubai, just not on a Delta plane. It’s a way to reduce risk. Next up: the truth behind why planes don’t fly over the Pacific Ocean.

American’s Doha choice

American Airlines leans on Doha as its main Middle East gateway. This focus keeps it tied closely to Qatar Airways. It’s a partnership that benefits both sides.

For Americans, this strategy avoids head-to-head battles in Dubai while still serving customer demand. Travelers still reach key cities through smooth connections. It’s a compromise that has held strong, even as voices like Frontier’s CEO warn of challenges ahead for U.S. air travel.

Liked this? Share your thoughts below and follow for more updates on travel, airlines, and the world’s busiest routes.

Read More From This Brand:

- Why American tourists are falling out of love with Las Vegas

- Citizens of more than 70 countries can now visit China without a visa

- The Japanese ryokans and art museums that will make you want to return again and again

Don’t forget to follow us for more exclusive content right here on MSN.

This slideshow was made with AI assistance and human editing.