Weather is reshaping travel

Extreme weather is no longer rare or distant for travelers. Floods, heatwaves, hurricanes, and wildfires now shape how trips are planned. Travel insurance has quietly become one of the most important booking decisions.

Insurers are updating policies as climate risks rise worldwide. Coverage rules are stricter, more detailed, and less flexible than before. Let’s dive in and see how the weather is changing the fine print.

Climate risks drive policy changes

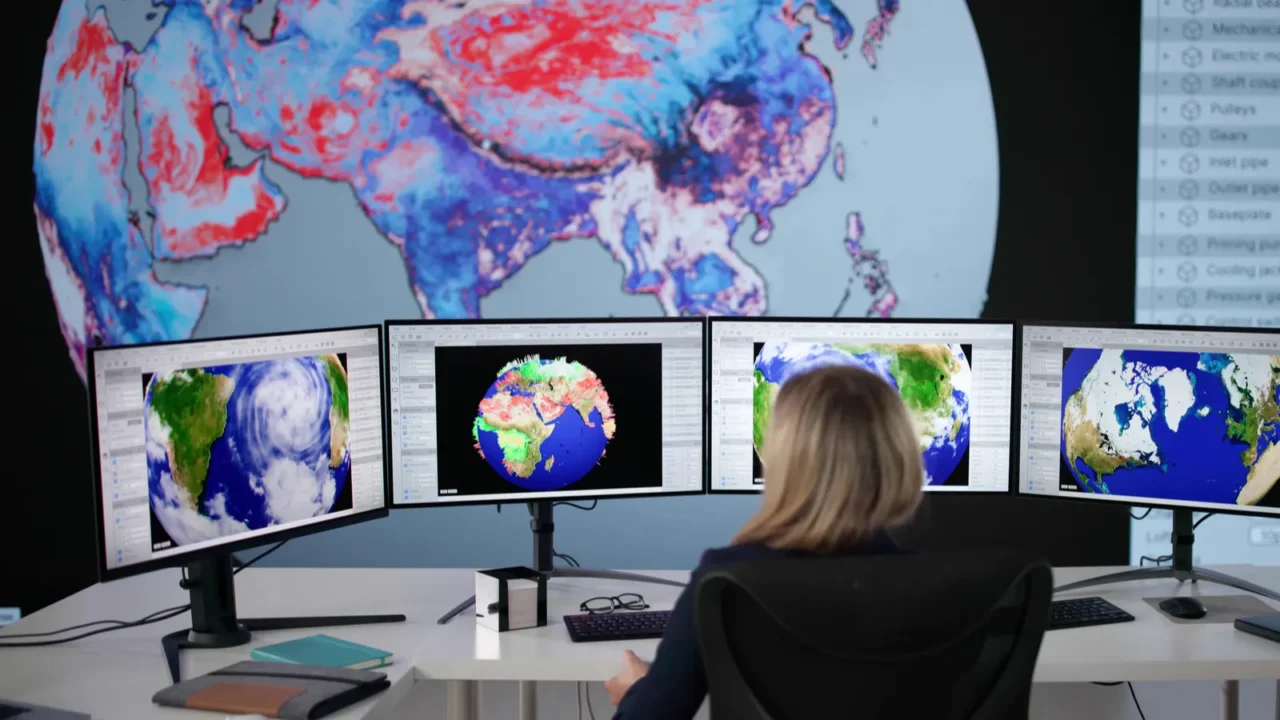

Insurance companies now analyze climate data closely. Regions with frequent storms or fires face tighter coverage conditions. Premiums and exclusions reflect these environmental realities.

Places like Florida, California, and Southeast Asia see frequent adjustments. Policies evolve as extreme weather becomes more predictable and less unexpected. Travelers feel the shift immediately when reviewing coverage options.

Hurricanes affect coastal trips

Hurricane-prone destinations face stricter insurance rules. Caribbean islands and Florida coastal cities now require storm-specific coverage clauses. Standard plans may no longer cover cancellations tied to named storms.

Insurers track hurricane seasons more aggressively than before. Coverage windows close once storms are officially forecasted. Timing now matters as much as destination choice.

Wildfires reshape coverage limits

Wildfires increasingly impact popular travel regions. California, southern Europe, and parts of Australia face seasonal fire risks. Insurance policies now include fire-related evacuation clauses.

Some plans exclude smoke disruption unless evacuation orders are issued. Travelers must read the details carefully before booking. Fire season has become a defined insurance category.

Flood zones face exclusions

Flooding now ranks among the most common travel disruptions. Cities like Venice, Bangkok, and Jakarta see frequent water-related delays. Insurance providers adjust coverage based on flood history.

Some policies exclude damage from known flood zones. Others require specialized add-on coverage. Water risk is no longer treated as an unexpected event.

Heatwaves disrupt itineraries

Extreme heat affects travel more than expected. Southern Europe and the Middle East experience frequent heat advisories. Insurance plans now reference heat-related medical coverage.

Trip interruption due to extreme temperatures is limited. Coverage often applies only to health emergencies. Heat has quietly entered policy language worldwide.

Winter storms impact mobility

Winter travel carries an increasing risk. Snowstorms disrupt flights, trains, and road access across North America and Europe. Insurance coverage now distinguishes between normal delays and severe weather events.

Places like Canada, the Alps, and northern Japan are closely monitored. Policies specify weather thresholds for claims. Winter reliability is no longer assumed.

Named storms trigger deadlines

Insurance eligibility often depends on the naming of storms. Once a hurricane or cyclone is named, coverage rules change instantly. Travelers booking late may lose cancellation protection.

This affects destinations like Mexico, Japan, and the Philippines. Timing policies around forecasts has become essential. Awareness protects travelers from denied claims.

Medical coverage grows critical

Extreme weather increases health-related travel risks. Heat exhaustion, respiratory issues, and injuries are on the rise. Insurance policies now emphasize emergency medical evacuation.

Remote regions require higher coverage limits. Countries like Iceland and New Zealand stress preparedness. Medical clauses are no longer secondary considerations.

Adventure policies gain importance

Adventure travel faces stricter insurance terms. Hiking, diving, and glacier tours carry climate-related risks. Insurers now separate standard and high-risk activities clearly.

Destinations like Peru, Nepal, and Costa Rica are affected. Weather volatility increases activity cancellations. Specialized coverage protects both travelers and operators.

Airlines influence insurance rules

Airline policies interact with insurance coverage. Weather related cancellations may not trigger refunds. Insurance often fills the gap left by airlines.

This is common during storms in Europe and the United States. Travelers rely on insurance for accommodation and rebooking costs. Policies reflect airline limitations more than ever.

Transparency matters more now

Insurance providers demand careful reading of terms as travel warnings increase for destinations facing extreme weather this season. Fine print outlines weather thresholds clearly and reflects real-time risk assessments. Transparency replaces broad protection language across most modern policies.

Savvy travelers compare policies before booking destinations. Climate risk awareness shapes smarter travel planning. Insurance becomes a strategic decision.

Travel planning looks different

Extreme weather has changed how trips are protected. Insurance now reflects climate reality rather than rare disruption. Smart coverage supports confident travel decisions. The best trips balance preparation with flexibility.

Which destination feels worth the extra coverage right now? Share thoughts and travel experiences below.

This slideshow was made with AI assistance and human editing.

Don’t forget to follow us for more exclusive content right here on MSN.

Read More From This Brand: